What we can learn from Sweden: How can the roll-out of true open access fiber networks succeed in Germany?

In his article, Mikael Häußling Löwgren (Swedish Fiber Optic Alliance) describes how regionally located fiber optic providers in Germany can learn from the experiences of Swedish providers and why an open access model is the key to successful FTTH marketing. In a total of three parts, the author discusses the advantages and disadvantages of potential business models for municipal utilities and local FTTH providers and presents these in detail.

Part 1: Overview of business models

The Swedish success model of fiber optic expansion is impressive: over 80% of all households there already have access to FTTH/B connections. Local carriers provide a large proportion of these. How can this experience be transferred to Germany and how can local providers, i.e. municipal utilities, benefit from it?

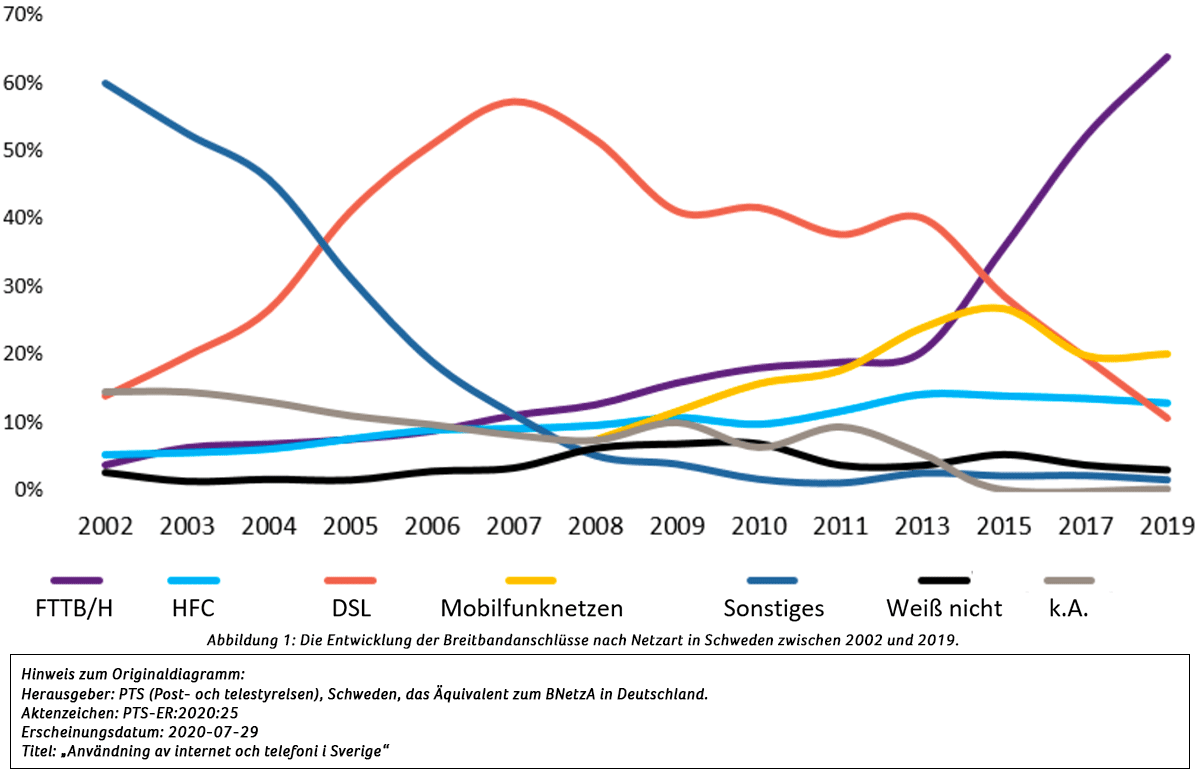

In Sweden, the first municipal carrier began expanding its fiber optic network in the early 1990s. Today, there are around 170 municipal local carriers in 200 of Sweden’s 290 municipalities. Together, they account for more than 50 percent of the fiber optic access network infrastructure. Through extensive homogenization, these carriers have succeeded in creating a nationwide online market for Internet, telephony and all other digital products, which has put pressure on Swedish Telekom (Telia). In 2008, the distribution of broadband connection types in the Swedish fixed network was similar to that in Germany in 2020: around 70% were DSL connections. 11 years later, in 2019, there were only 12.2% DSL connections in Sweden, but already 75.6% FTTH/B connections (see Fig. 1).  If one knows that the market rules, especially for the companies with market power, are similar in Sweden and Germany, and one does not believe that the development in Sweden is based on socio-cultural conditions, then this development can also be predicted for Germany. Sweden has over 25 years of market experience in fiber optic expansion and network operation. Today, more than 80 percent of households have access to an FTTH/B connection. The important experience gained in Sweden: The local carriers were able to overcome market fragmentation because they adapted their business models to open access – at the level of active wholesale products (layer 3; bitstream access).

If one knows that the market rules, especially for the companies with market power, are similar in Sweden and Germany, and one does not believe that the development in Sweden is based on socio-cultural conditions, then this development can also be predicted for Germany. Sweden has over 25 years of market experience in fiber optic expansion and network operation. Today, more than 80 percent of households have access to an FTTH/B connection. The important experience gained in Sweden: The local carriers were able to overcome market fragmentation because they adapted their business models to open access – at the level of active wholesale products (layer 3; bitstream access).

A comparison of the business models

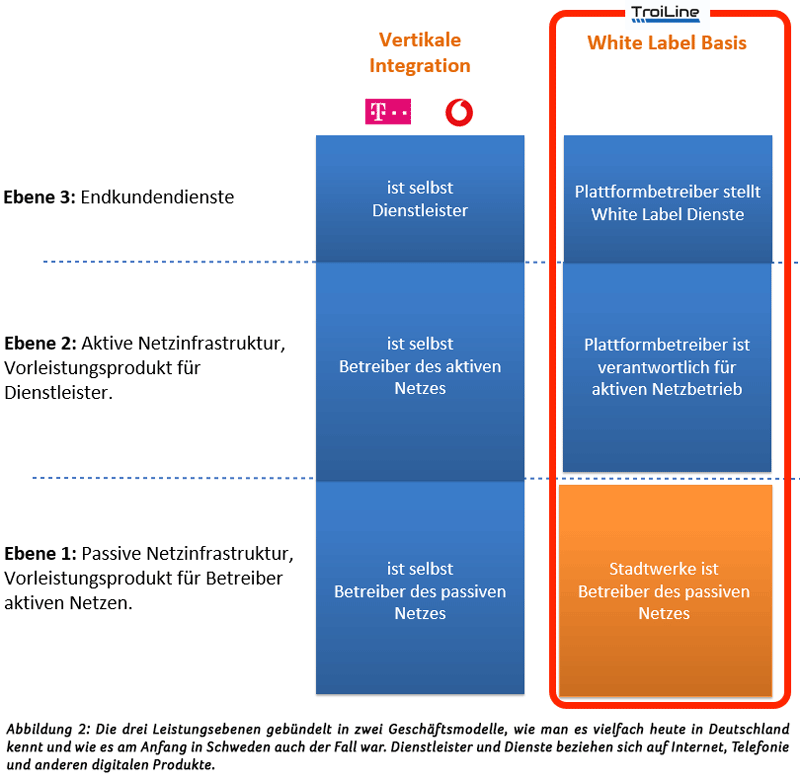

In the beginning, the Swedish local carriers were fully vertically integrated. In other words, it was the same as in many cases in Germany today: the local carriers themselves offered different speeds at different prices. As in Germany, they had established a brand for their Internet offering. The structure of this business model is as follows (see also Fig. 2): The local carriers are network owners and operate the network or have it operated and offer their own services to end customers. Why did they offer their own services, or in other words, why did they not allow the products of other service providers, such as Internet, telephony, IPTV and other digital products (henceforth “service providers” for short), on their networks? The answer is obvious: initially, there was no other service provider apart from Swedish Telekom. And Telia did not want to offer its services on other networks. As a result, they offered their own products. That was the case at the beginning of the 90s. By 2004, however, 45 percent of Swedish carriers said that they now had several service providers on their network.

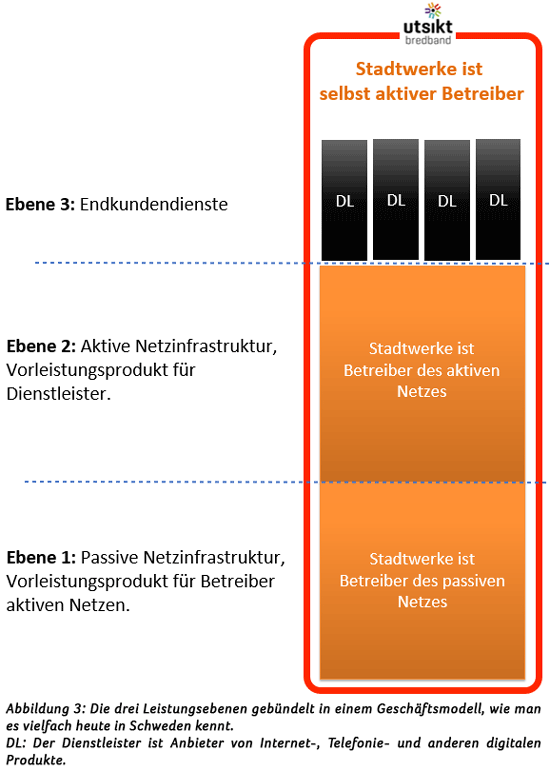

In the beginning, the Swedish local carriers were fully vertically integrated. In other words, it was the same as in many cases in Germany today: the local carriers themselves offered different speeds at different prices. As in Germany, they had established a brand for their Internet offering. The structure of this business model is as follows (see also Fig. 2): The local carriers are network owners and operate the network or have it operated and offer their own services to end customers. Why did they offer their own services, or in other words, why did they not allow the products of other service providers, such as Internet, telephony, IPTV and other digital products (henceforth “service providers” for short), on their networks? The answer is obvious: initially, there was no other service provider apart from Swedish Telekom. And Telia did not want to offer its services on other networks. As a result, they offered their own products. That was the case at the beginning of the 90s. By 2004, however, 45 percent of Swedish carriers said that they now had several service providers on their network.  In 2014, 73% and in the last survey in 2019, 96% had products from other service providers on their networks. What happened? The Swedish local carriers had changed their business model. They now offer Open Access on two levels, as shown in Figure 3. A concrete example is the local carrier Utsikt AB in Linköping, a city with 160,000 inhabitants. There are now more than 20 service providers on Utsikt’s network. These include the Swedish and Norwegian telecoms companies. Private customers in the connected single-family homes and apartments can now choose freely from the products of these service providers. If they are not satisfied with their choice, they can switch to another provider with 30 days’ notice.

In 2014, 73% and in the last survey in 2019, 96% had products from other service providers on their networks. What happened? The Swedish local carriers had changed their business model. They now offer Open Access on two levels, as shown in Figure 3. A concrete example is the local carrier Utsikt AB in Linköping, a city with 160,000 inhabitants. There are now more than 20 service providers on Utsikt’s network. These include the Swedish and Norwegian telecoms companies. Private customers in the connected single-family homes and apartments can now choose freely from the products of these service providers. If they are not satisfied with their choice, they can switch to another provider with 30 days’ notice.

Hen or egg?

There is much discussion about open access in Germany. In Sweden, this is already standard. Today, there are many service providers in Sweden that do not have their own network. They offer their products on many or all of the fiber optic networks of Sweden’s 170 local carriers. Telia also offers its Internet products on third-party networks and, conversely, allows third-party service providers to use its own fiber-optic network. In Germany, this scenario is still a dream of the future. Many municipal utilities in Germany are wondering where the many service providers came from and why Telia gave in? What comes first, the providers or the market? The market must come first. Would Swedish Telekom have opened up its network voluntarily? No, only when many customers switched to local carriers with open networks did Telia feel compelled to do so. The first open fiber optic networks in Sweden had only one service provider, the local carrier itself. Then one began to advertise that its network was not closed like the networks of cable TV providers and telecom competitors. The first entrant to its network was a DSL provider that wanted to offer its Internet products under its own brand on third-party fiber optic networks. The ability to switch to another service provider without having to replace the ONT/CPE1 became the local carrier’s best selling point, as customers appreciated the freedom of choice. The change in the market had begun: Other market entrants followed and other local carriers copied the successful concept. With many service providers in the market, increased competitive pressure arose, forcing greater efficiency among providers and bringing lower prices to customers. The local carriers were also able to enjoy higher network utilization. In market terms, it is quite simple: a separation between services and network operation created a market. If all local carriers do this, a large national market is created. Service providers can reach all connected homes and businesses across the country. This in turn means economies of scale for the service provider and lower prices for customers. In technical terms, this means that the party operating the active network, the local carrier itself or a third party, provides the ONT/CPE and the other active network components so that end customers can switch service providers without having to replace their ONT/CPE. The customer changes the service provider in an online portal, which he can access via the website of his local carrier. Where there is a market and money to be made, companies will enter. The market entrants were DSL providers, IT/telecom specialists and cable TV providers. They all became service providers without their own fiber optic network, in this sense network-independent service providers. Only much later did Swedish Telekom enter the market and then open its own fiber optic network. So the lesson from Sweden is that if the local carriers open up their networks at the level of an active wholesale product and create a market, then provider diversity will emerge. In the end, other network providers, such as (Deutsche) Telekom, will also open up their networks and offer their services in the fiber optic networks of local carriers.

The article will be continued in the next aconium newsletter. You will then find out more about the details and characteristics of individual business models.

By Mikael Häußling Löwgren, Swedish Fiber Optic Alliance. The original version of this article was published in Cable!vision Europe 02/2021.

The Swedish Fiber Optic Alliance is an initiative of the association “Svenska Stadsnätsföreningen” for the exchange of knowledge on fiber optics between Sweden and Germany. “Svenska Stadsnätsföreningen” is an industry and interest group. Its members are local carriers in almost 200 of Sweden’s 290 municipalities and 135 providers of network services and equipment.

Background to the research: In spring 2020, the Swedish Fiber Alliance and BUGLAS launched a project, a GAP analysis, which compared the business models between the Swedish local carriers and the German local carriers. BUGLAS member company Troiline GmbH was actively involved in the project. The GAP analysis was presented and discussed for BUGLAS member companies in a webbinar.

Mikael Häußling Löwgren is a Swedish telecommunications engineer, economist and chairman of the Swedish Fiber Alliance initiative and has more than 30 years of German-Swedish sales and business experience. For many years he has been involved in the development of the civil fiber optic market in Sweden and Germany. He is therefore very familiar with the topic in both countries, can make profound comparisons and draw appropriate conclusions.

Swedish fiber optic alliance

Mikael Häußling Löwgren

+46 (0) 704 223431

mikael.haussling(at)ssnf.org